Ace Micromatic: The Biggest Manufacturing Trends Created By COVID 19

The impact of the Novel Coronavirus is so significant that globally, some major shifts and trends seem to have emerged. Here is a list of changes for better or for worse.

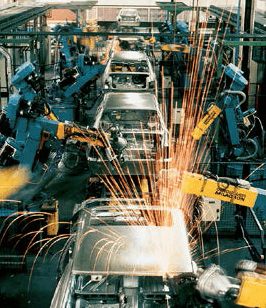

Demand surges for personal vehicles

The effects of the virus have created panic within people causing changes in their commuting behaviors. A global survey done by Cars.com with over 3,000 men and women between the ages of 23 and 73 years of age in March suggests that over 40% of them have stopped using ride-sharing modes like Uber and Lyft.

Since a ride-sharing car would have come in contact with dozens of people, the survey informs that over 90% have started using their cars. The outcome is that around 20% are already planning to buy personal vehicles instead of using public or shared modes of transport. This would suggest that there will be a surge in automobile demands across the world thanks to the pandemic nature of COVID-19.

Supply chain reliability:

The international slowdown has severely affected international trade supply chains. Supply chains in healthcare, retail industries, food, travel & tourism, high-tech manufacturing, and, especially the automotive industry have been particularly hard hit. Hubei province, where the virus started, accounts for close to 9% of China’s automobile production. It’s also a center for auto parts manufacturing for domestic and many heavily reliant overseas manufacturers. Plant closures have already upended global automotive supply chains.

With stocks depleting rapidly, manufacturers are now left gaping and scrambling for reliability. This has pushed for a deeper look into the management of supply chains. Sourcing locally, and relying on alternate suppliers will strengthen supply chains helping bring more stability in delivering products. This trend was already in the making but the tipping point was the sudden disruption due to the coronavirus.

Manufacturers want to reinforce to their customers that they take their sources seriously.

Not making in China

China affects more than half the economies of the world. But the bigger lesson to take is how unpredictable the Chinese market could be.

Added to President Trump’s trade and tech wars, with companies such as Apple announcing plans last year to diversify its manufacturing, which was heavily reliant on China, the outbreak has chipped out more credibility from the country.

Reduced Chinese imports will create a higher demand for commodities in India, according to Anil Agarwal. “Overseas, the impact is at least 10-15 percent, but in India, people are cautious and demand is high because there will be fewer imports, so Indian industry will be okay,” the founder and chairman of Vedanta Resources Ltd. told Bloomberg

Bigger inventories

The “just-in-time” model of production and deliveries started in the 1960s and ‘70s where companies maintained minimum inventory to meet projected needs. When trade is stopped due to the virus this created a pinch leaving manufacturers wishing they had ordered a little more to meet the demands.

This pinch will surely change the size of inventories for the bigger. People would rather stock up than wish they had more. Such unpredictable situations might come up in the future and manufacturers need to be prepared.

Sourcing locally

The outbreak has caused two things: fear of touching things from the unknown (especially china) and the volatile nature of international supply chains. Brands are seriously considering to vertically integrate local supply chains ensuring that products are “Made in India” with Indian sources as this will support the people of the country. The sentiment will also drive buyers to see if products are made locally which in turn increases demand.

Buying and paying online:

In response to the outbreak, the World Health Organization (WHO) is recommending that consumers pay remotely than with cash. This stems from the fear that physical money can spread the virus as well. Some countries are taking this a step further: South Korea, for example, is quarantining all cash received at the central bank for two weeks before sanitizing and putting it back into circulation. Restrictions on cash combined fear might push consumers to heed the WHO’s advice. This could boost non-cash payments, which we already expect to grow at a 10.5% CAGR from 2019 to 2024.

With more and more people becoming familiar with smartphones and their technologies, adding the current situation in hand, people are pushed to use online methods. Brands are taking note and this is no longer restricted FMCG but B2B brands as well.

Manufacturers want to cut to the chase

Standard distribution channels will be soon overtaken by Direct to Consumer (D2C) methods of retail. When a process can be shortened why would we use the old methods?

While younger consumers have readily adopted D2C brands, older consumers are wary to catch up. And despite the many breakout brands that have gained widespread international acclaim many D2C brands are still largely less well-known than their established competitors.

The global pandemic is again a catalyst for this change. As consumers shift more of their spending from in-person to online, D2C brands are likely to get a significant boost thanks to the Coronavirus.

Working digitally

When buying can be done online why not apply it to all things retail. Besides, online is faster and easier to adapt to changing times. The malleability of an online platform is helping both buyers and sellers gain benefits. This nudge, though born out of necessity, may finally be what pushes business past the brick and mortar structure and onto the internet. Now businesses, are along with conventional methods, using the internet to get their work done.

This is also applicable to working for the business. With work-from-home, a boon in such times, digital is the future.

Governments will put more money on healthcare

A total lockdown spells losses and the downward spiral of an economy. The government has learned that it would rather spend on preventive care than spend multiple times more doing damage control. According to a new paper on the macroeconomic impact of the virus published by the Brookings Institution and co-authored by Warwick McKibbin and Roshen Fernando of the Australia National University, “The global community should have invested a great deal more on prevention in poor countries,”. Warwick McKibbin was also co-author of a previous paper that estimated the 2003 SARS outbreak wiped $40 billion off the world economy.

Now, more than $8 billion has been pledged across the world to find a vaccine for the novel coronavirus COVID-19. Coalition for Epidemic Preparedness Innovations (CEPI) has identified at least 115 ongoing vaccine initiatives that are in the race to find a solution, worldwide.

This also means new healthcare policies that protect the country from future pandemics or anything just as destructive will have to be created to protect people’s health and the economy.

Buying habits have changed:

With the lockdown came panic buying. With the fear that there will be limited resources, people started showing unique consumer behavior like:·

- Buying preventive wellness products

- Hoarding groceries & household items

- Visiting stores less often

- Buying protective gear like masks and hand sanitizers It can be guaranteed that for generations to come some of these habits will be a priority for buyers which will change the shape of marketing, branding, even manufacturing for that matter.

This content was first published on Ace Micromatic website.